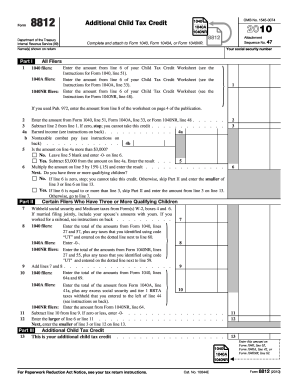

IRS 8812 2011-2026 free printable template

Instructions and Help about IRS 8812

How to edit IRS 8812

How to fill out IRS 8812

Latest updates to IRS 8812

All You Need to Know About IRS 8812

What is IRS 8812?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8812

What should I do if I need to correct an error on my IRS 8812 after filing?

To correct mistakes on your IRS 8812, you need to file an amended return using Form 1040-X. Include the corrected IRS 8812 with your amendment. Make sure to provide explanations for the changes to ensure proper processing.

How can I check the status of my IRS 8812 submission?

To verify the receipt and processing of your IRS 8812, use the IRS ‘Where's My Refund’ tool if filed with a Form 1040. If you e-filed, keep an eye out for email confirmations from your software provider regarding the status of your submission.

What should I do if my IRS 8812 submission is rejected?

In the case of a rejected IRS 8812 submission, check the rejection code provided, which will guide you on the issue. Correct the identified problem and resubmit your form as soon as possible to avoid delays in processing.

Can electronic signatures be used on my IRS 8812?

Yes, electronic signatures are acceptable for your IRS 8812 when e-filing. Ensure that your e-filing software complies with IRS standards for e-signatures to maintain the validity of your submission.

What privacy measures should I take when submitting my IRS 8812?

When handling your IRS 8812, ensure you use secure software for e-filing and avoid sharing personal information in unsecured environments. Retain copies of your submission and supporting documents for your records, in compliance with IRS guidelines.

See what our users say